Last updated 11.06.2025

How HSAs and FSAs can help pay for dental implants—and save you money

Explore how HSA and FSA funds can be used toward dental implant treatment and lower out-of-pocket costs.

An HSA (Health Savings Account) is a personal savings account available to people enrolled in a high-deductible health plan (HDHP). You can contribute pre-tax dollars to an HSA and use the funds for qualified medical and dental expenses.

An FSA (Flexible Spending Account) is an employer-sponsored benefit that allows you to set aside pre-tax money to pay for eligible healthcare expenses during the plan year. FSAs are typically “use-it-or-lose-it,” meaning unused funds may not carry over.

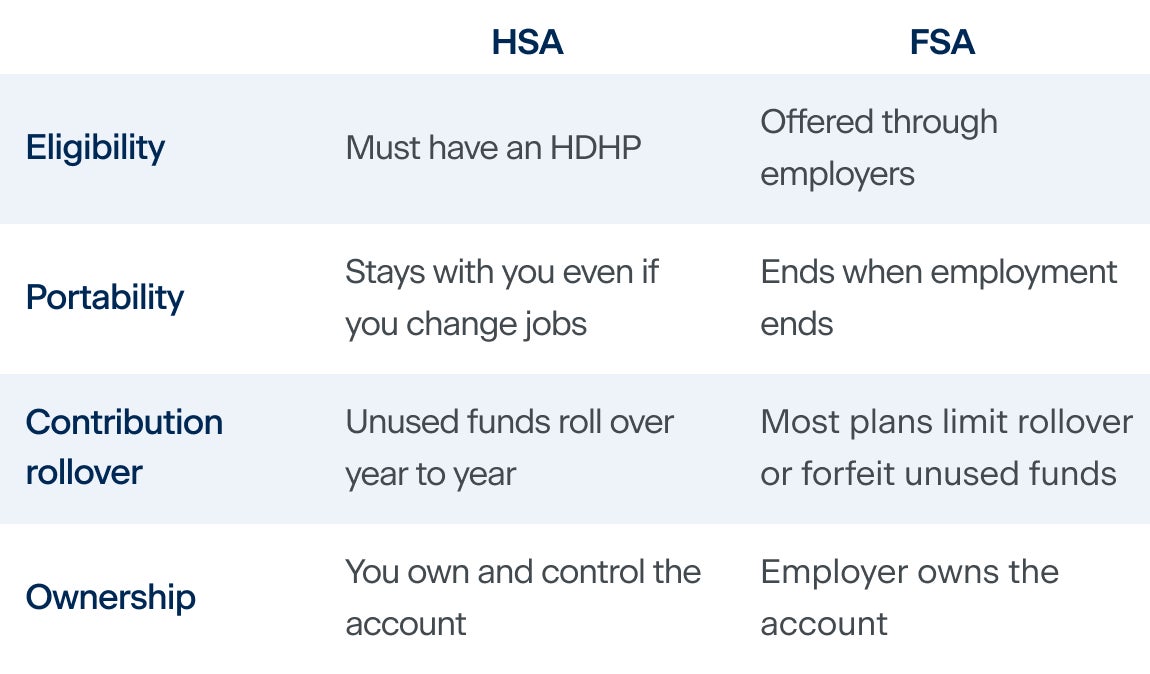

Key differences between HSA and FSA

Can you use an HSA or FSA for dental implants?

Dental implants and related procedures are generally eligible expenses as long as they are medically necessary to restore function, prevent disease, or manage oral health conditions. Eligible treatments may include:

Implant placement and restoration

Extractions or bone grafting related to implant treatment

X-rays and diagnostic imaging

Sedation or anesthesia related to implant surgery

Purely cosmetic procedures (for example, whitening or veneers) are typically not eligible for HSA/FSA reimbursement.

Can I use both an HSA/FSA and insurance together?

Yes. HSAs and FSAs can be used to cover out-of-pocket expenses that your insurance does not reimburse.

Note: ClearChoice Dental Implant Centers do not process or accept insurance. However, patients may request detailed documentation to submit reimbursement claims directly to their insurance provider.

Maximizing value through annual contributions

If you know you’re planning a procedure such as a dental implant restoration, consider contributing the maximum allowed each year. Setting aside funds gradually can make treatment easier to afford while reducing the impact of large, one-time expenses.

Investing in your oral health with pre-tax accounts

Dental implants do more than replace missing teeth—they help preserve jawbone health, maintain facial structure, and restore the ability to eat and speak comfortably. Treating tooth loss can also support better nutrition, confidence, and long-term wellness.

By using pre-tax HSA or FSA funds, you can pursue care that improves your health and quality of life—without sacrificing financial stability. Planning ahead helps make implant treatment more achievable when you’re ready to move forward.

How ClearChoice supports affordability and access

At ClearChoice Dental Implant Centers, each patient receives a personalized treatment plan under one roof—from consultation to final restoration. Our all-inclusive approach brings together prosthodontists, oral surgeons, and a dedicated dental lab for streamlined, predictable care.

Insurance & third-party financing options

While ClearChoice does not accept insurance, our team provides the documentation you need to file a reimbursement claim. For patients exploring additional payment flexibility, third-party financing options are available through outside lenders.

Our goal is to help you understand your options and make confident, informed decisions about your care.

The bottom line

HSAs and FSAs can make high-value dental care, like implant treatment, more accessible. By using pre-tax funds, you can invest in your smile and protect your overall health at the same time.

If you’re considering dental implants, the team at ClearChoice Dental Implant Center can walk you through the process, help you understand your documentation needs, and connect you with available third-party financing resources.

Schedule a consultation today>

HSA and FSA dental implant cost FAQs

Are dental implants HSA-eligible?

Refer to IRS Publication 502 for official guidance on qualified medical and dental expenses.

Can I use my FSA or HSA to pay for a dental implant consultation?

You need to consult with your provider to identify the limitations. We have seen consultations, X-rays, and diagnostic imaging associated with medically necessary treatment generally qualify.

How do I know if my dental procedure is covered?

Check with your HSA/FSA administrator or employer’s HR department. They can confirm whether a specific procedure meets IRS eligibility requirements.

Can I combine insurance, HSA/FSA funds, and financing?

Yes. You can use your account funds to pay for out-of-pocket expenses and apply for third-party financing if needed.

Does ClearChoice accept HSA or FSA cards directly?

Many ClearChoice centers accept HSA or FSA debit cards. If not, patients can pay out of pocket and request an itemized statement for reimbursement, if any, from their administrator.